Pre-Tax Savings Accounts

Quotient's Pre-Tax Savings Accounts include Health Savings Accounts (HSA), Flexible Spending Accounts (FSA), and Commuter benefits. This page contains information related to the transition, the rollover parameters of your current funds, and provides additional resources to help you get to know our new administrator, ThrivePass!

-

When can I access ThrivePass.com and contact customer service?

Instructions for registering your account with ThrivePass will be emailed the first week of January, 2022. Once you are registered, ThrivePass will send a debit card to your home, which can be used to pay for qualified expenses

-

When will I receive my ThrivePass debit card? How do I order cards for my family?

ThrivePass debit cards will be mailed in the first week of January. You will receive one debit card for yourself that you can use to access your HSA, FSA, and Commuter benefit funds. You can request separate cards for your spouse and adult dependents at no additional cost. The new cards will be valid and active for five years. You can request additional cards for your eligible dependents through your thrivepass.com account.

-

Still have questions about using ThrivePass?

Starting 1/1/22, you can contact ThrivePass at 866-855-2844 or tpa@thrivepass.com.

-

Why is my ThrivePass account showing a $0.00 balance?

With the HSA, you can change your election amount at any time, so there's no set amount and this is the reason the system doesn't show a HSA balance. You will begin seeing a dollar amount in your available balance on 1/15.

Dependent Care is going to show a set amount because you don't have the ability to change this election during the plan year. Your DC FSA amount will be deducted from your paycheck over the 24 pay periods.

-

When can I start spending my funds?

With a Healthcare and Limited Purpose FSA, your entire annual election amount is available on the first day of the plan year even though you have not yet contributed that amount. With Dependent Care FSAs, HSAs, and Commuter benefits, you will have access to funds as they are deducted from your paycheck.

-

How do I change my 2022 election?

You can make HSA or Commuter contribution changes in Workday anytime, but you need a Qualified Life Event (QLE) or wait until Open Enrollment to change your FSA elections. For instructions on how to make changes, review the Benefits Changes in Workday Job Aid.

-

Where can I find a list of qualified medical expenses (QME)?

QMEs are designated by the IRS. They include medical, dental, vision and prescription expenses. See IRS publication 502 or IRS publication 969 for more information. Starting 1/1/22, you will also be able to download the ThrivePass Pre-Tax Accounts app, available through in your app store, and use your mobile device to scan items, such as facemasks and medication, to see eligibility.

-

Will my HSA election from Workday be automatically applied to ThrivePass? Or do I need to setup a contribution election within ThrivePass?

The HSA election made in Workday are fed to ThrivePass on a semi-monthly basis. You do not need to make elections within the ThrivePass system.

Optum to ThrivePass HSA Transfer

Quotient will offer a bulk transfer upon your approval of the transfer. Please review the table below to help you weigh the considerations for transfer. Each accountholder should carefully evaluate their situation to make an appropriate decision. Multiple HSA accounts is not uncommon, and we believe allowing each person to make a personal decision to either maintain or terminate this account is aligned with the feedback we’ve received recently.

| Question | Consider Maintaining Your Optum Account | Consider Transferring to ThrivePass | Why? |

|---|---|---|---|

| Do you have investments with Optum? | YES | NO | Account Holders participating in investment options must liquidate investments prior to directing Optum Bank to transfer funds |

| Does the $20 transfer fee outweigh the Optum administration fee? | YES | NO | Optum will deduct a $20.00 transfer fee prior to transferring the funds. Click here for more information on the account management fees of Optum. |

| Do you need access to your Optum funds in Q1 2022? | YES | NO | There will be a 30-day black-out period where account holders must discontinue use of their accounts to allow outstanding transactions to settle. Transferred funds will be available in ThrivePass 2 weeks following the fee deduction. |

| Do I have less than $20 in my Optum HSA? | YES | NO | Individuals with less than $20.00 in their accounts will not transfer. |

| Are you using Betterment? | YES | NO | While you can invest through ThrivePass, the Betterment investment resource is only available through Optum. However, you can invest in other options through ThrivePass. |

| Are you avoiding Account Management Fees? | YES | NO | Click here for more information on the account management fees of Optum. |

HSA Transfer FAQs

-

If I currently have an HSA through another custodian, what happens to this account?

You have the ability to maintain your current HSA with the current custodian. It is not required to move funds to your new ThrivePass HSA however, the current custodian may charge fees to maintain that account. Your new ThrivePass account will exist in order for you to continue to receive the tax-savings option through payroll deductions. Click the blue link below to be included in the bulk transfer.

-

If I elect to transfer funds, when can I expect to see the transferred funds in my new HSA?

If you make the decision to be included in the bulk transfer from Optum to ThrivePass, please review the timeline to understand your blackout period and associated key dates. If you decide to not participate in the biulk transfer, you can use the HSA rollover form anytime to initiate a transfer. Transfer timelines are driven by the current custodian and US Mail delivery times (can take between 3-6 weeks). Upon receipt of your request to transfer funds, the current custodian will initiate that process. All HSA transfers are generated by check that are mailed to the new custodian. We suggest you inquire with the current custodian to confirm their internal policies and timelines. Once ThrivePass receives the funds, funds are generally able to be viewed under your new ThrivePass HSA within 3-5 business days from receipt.

-

Will I to need re-invest any funds that were invested previously?

Yes, you will need to re-invest funds once they have posted to your new account – the process is not automatic. First, you will need to apply for an investment account, which takes around two business days to set up. Then you can invest any funds over the $1,000 minimum cash balance required for investing.

-

If I currently have investments how will I handle those?

You will need to liquidate any investments prior to the closing of your current HSA. If investments are not liquidated, this could delay or prevent the account closure.

-

Still have questions about using ThrivePass?

Starting 1/1/22, you can contact ThrivePass at 866-855-2844 or tpa@thrivepass.com.

-

What are my investment options through ThrivePass

ThrivePass has a number of investment options.

Click here to better understand your investment options through ThrivePass.

Flexible Spending Account (FSA)

-

Health FSA

You can use the Healthcare FSA funds to pay for eligible healthcare expenses when you enroll in a PPO or HMO plan.

-

Limited Use FSA

The Limited FSA can be used for eligible dental and vision expenses when you enroll in the CDHP.

-

Dependent Care FSA

The Dependent Care FSA funds can be used for eligible childcare expenses during parents' work hours.

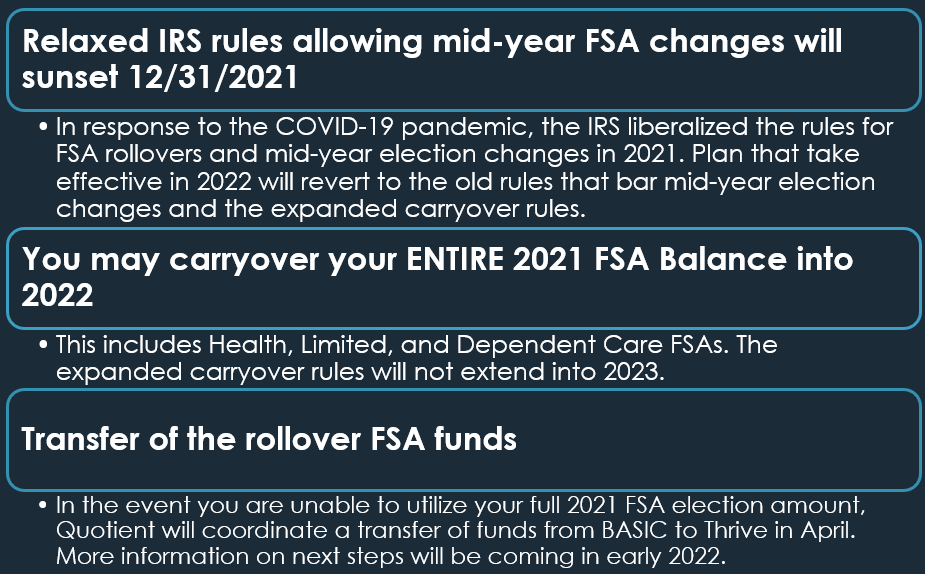

FSA Rollover

2021 Health and Dependent Care FSA

Use Your 2021 Health and Dependent Care FSA

- Last day to incur 2021 FSA expenses for reimbursement will be December 31, 2021

- Expenses incurred in 2021 can be submitted for reimbursement, at BASIC, through March 31, 2022.

- For more information on how to submit for reimbursement, click here.

Commuter Benefits

Commuter benefits will be administered by ThrivePass beginning on January 1. Please review the timeline below for more information on the transition from WageWorks to ThrivePass.

-

When will I receive my ThrivePass debit card?

If you have not received your ThrivePass debit card in the mail by December 27, please reach out to ThrivePass at (866) 855-2844 . You will receive one (1) debit card, which can be used for your Health Savings Account (HSA), Health FSA, Limited FSA, Dependent Care FSA, and Commuter benefits.

-

When can I begin using my ThrivePass debit card for commuter expenses?

You will pay for qualified transportation with your ThrivePass debit card beginning February 1. You will not need to place a commuter order ahead of time to use your commuter benefits.

-

I am currently working from home - can I change my Commuter benefits election at any time?

Yes. You can change your commuter elections on a prospective basis.

-

Is there a fee associate with the bulk transfer?

Yes. Institutions typically charge a fee to transfer funds to another instiutation. As such, WageWorks will change a $25 trasnfer fee. This fee will be taken from your pre-tax forfeiture amount.

Other Resources

Quotient offers multiple pre-tax saving and spending accounts to fund your healthcare expenses. By using untaxed dollars to pay for deductibles, copayments, coinsurance, and some other expenses, you may be able to lower your overall health care costs.

-

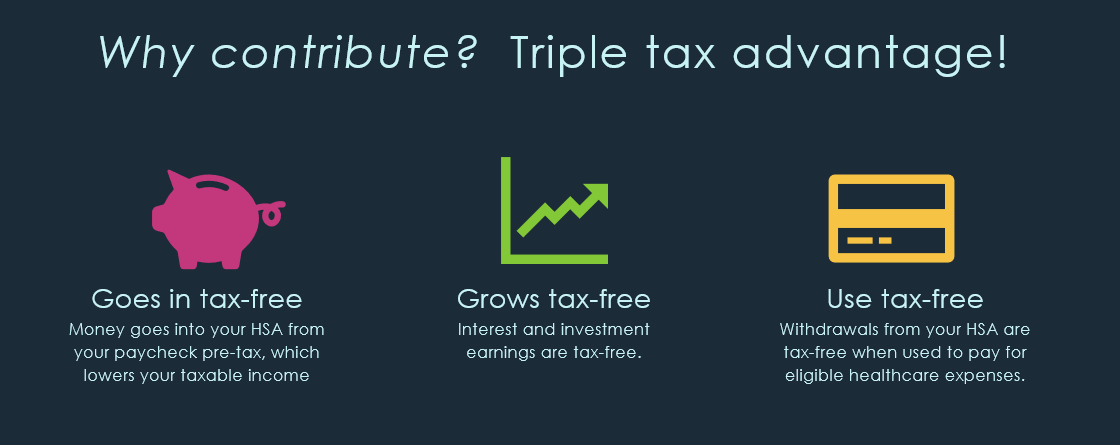

Health Savings Account (HSA)

A Health Savings Account (HSA) is a specialized program that allows you to save for healthcare expenses, tax-free. The idea behind a Consumer Driven Healthcare plan is to divert the money you would have spent in employee premium contributions and instead save these dollars into your HSA. You may want to consider contributing to your HSA as a way to help cover future qualified medical expenses for you and your eligible dependents. The HSA is yours to keep, even if you change jobs or medical plans, retire, or leave the company.

Quotient will make semi-monthly deposits into your HSA when you enroll in a CDHP medical plan.

- Up to $1,200 annually if you enroll as an individual

- Up to $2,400 annually if you enroll dependents

Click the links below for helpful resources!

-

Flexible Spending Account (FSA)

You can use the Healthcare FSA funds to pay for eligible healthcare expenses when you enroll in a PPO or HMO plan.

The Limited FSA can be used for eligible dental and vision expenses when you enroll in the CDHP.

The Dependent Care FSA funds can be used for eligible childcare expenses during parents' work hours.

For more information please review the below.

Site Disclaimer

All Rights Reserved. Quotient, the Quotient logo, the Coupons.com logo, the SavingStar logo, Elevaate, QMX, Quotient Retailer iQ, Ahalogy, and Ubimo are trademarks or registered trademarks of Quotient Technology Inc. and its subsidiaries in the United States and other countries. Other marks are the property of their respective owners.